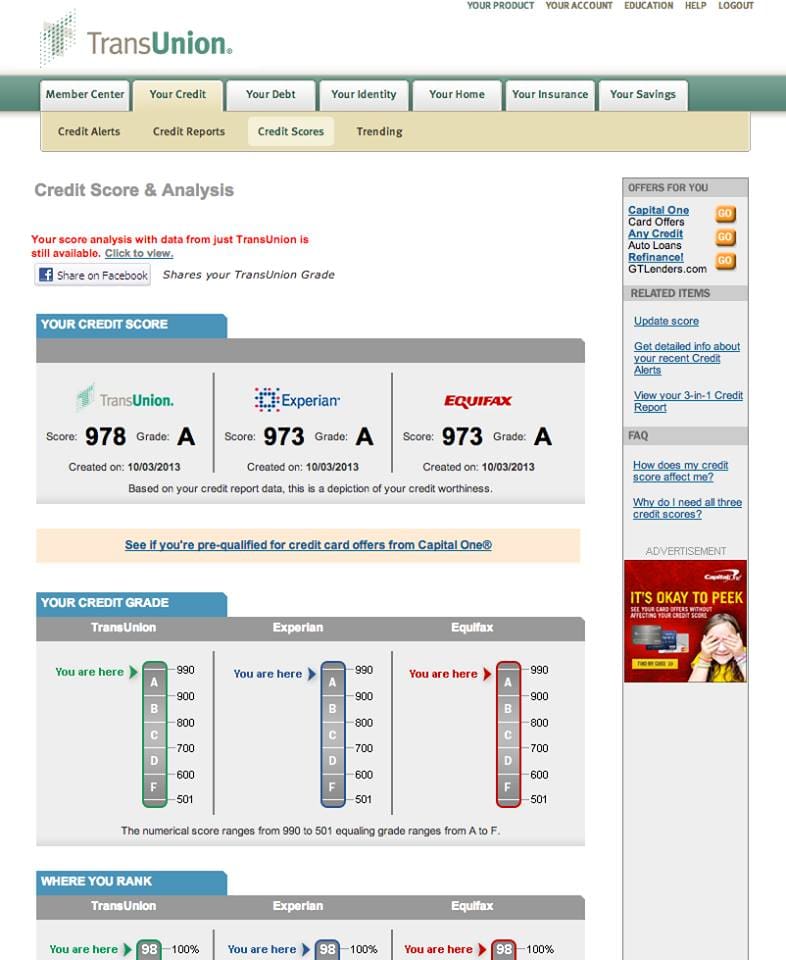

We live in a world that is built on credit/credibility. So the question that comes up is, what is next for Dance Mogul Magazine in terms of inspiring self-empowerment? The answer is the same thing that it has always been: economic sustainability. However, the climate has to be right and the people have to want it. There are so many professional people who would love to volunteer their time to do lectures and workshops for free to help the community and culture. But because people are looking for instant gratification, they are not willing to allow new and creative thinkers in the culture. That’s sad because it stunts our growth as a whole. Where are we going without credit and understanding how it works and what we can do to start to grow our potential? The future for pure Hip Hop is a good credit rating. Dance Mogul Magazine reached out to Angel Boose, a strong single mother, and public school teacher, to help bring credit awareness to the community. Let’s let our legacy shine together.

Dance Mogul: When did you first learn about credit and what it meant to your life?

Ms.Boose: I first learned about credit during my first year of college. I took part in an Economics course, which taught me about credit cards, the fees associated with using them, the interest that you pay on an amount owed overtime, etc. When I heard that a $500 purchase could cost you close to $1000 over time if you pay the minimum payment only, I was intrigued. Then I learned how building credit and having a good credit history could get you anything you wanted. I knew I wanted to have nice things and live a comfortable life. Coming from a family that was financially unstable, building good credit was the only support I could rely on.

Dance Mogul: As a teacher in the public school system, do you feel that kids should be taught about credit at a young age, even in school?

Ms.Boose: As a public school teacher, I absolutely think students should learn about credit. However, prior to being in high school, I don’t think it is necessary. High school students should begin being taught the advantages and disadvantages of credit cards, how interest accumulates on credit card purchases and the effects of not paying bills on time or at all. This way students are well educated about credit and can make informed decisions about it when they turn 18 and are able to begin establishing it. Prior to taking that college course I mentioned, I had never even heard of credit. Credit is so important and can make such a huge difference in a person’s life.

Dance Mogul: What are some of the ups and downs of maintaining a good credit score?

Ms. Boose: The “upside” of maintaining good credit is having access to loans, credit cards, and the ability to prove that you are a financially reliable and responsible person. The “downside” to maintaining good credit is sacrificing things. Rather than spending money frivolously on wants, you have to learn to restrict your spending on clothing, shoes, and outings. You have to learn to live within your means and buy only what you can afford to pay for. My golden rule is, if I can’t afford to pay cash for it now or can’t pay it off with my next check, it’s not worth having. Of course, that doesn’t apply to car loans and mortgages, but even when making decisions on a big purchase, you have to really know what you can afford to consistently pay and ensure you will have enough left over for food, gas, and other unexpected expenses.

Dance Mogul: Credit is important in all cultures and communities, but why is that so especially for the African-American community?

Ms.Boose: Most African-Americans are not born into money nor do they have access to people who have money. For this reason, building credit and maintaining good credit is essential. African-Americans already have so much against them, simply because of their race. Good credit is their key to getting things they may otherwise never have the cash to pay for. Your credit speaks volumes about who you are. The only thing that means more than race is money, which can be in the form of good credit.

Dance Mogul: How would you go about developing a system for an individual to get out of debt or to build on credit they already have.

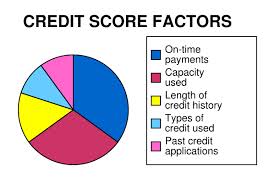

Ms. Boose: Building and having good credit doesn’t mean getting out of debt. The key is having debt you can maintain. To build credit, you have to have a debt to pay off to prove that you are a reliable and responsible person. You want to always be sure that your debt to credit ratio is low. That means the amount of debt you have should never be greater than the available credit you have. Lenders look at this to determine if you will be able to handle new debt. To begin building good credit, you have to right your wrongs. You should set up a payment plan with lenders you owe to begin paying off your debt, and you should make those payments at the agreed-upon time every month. All of your bills should be paid on time consistently. If possible, you should even try to get a new loan or credit card with a low credit limit such as $500 or below, make small purchases on it monthly, and pay it in full each month to begin rebuilding your credit. To build upon the credit you already have, you should do the same.

However, when you have credit cards, never use more than 50% of what you have available, 35% is an even better goal. Creditors do not want to feel like you use your credit as a means to an end. When you max out your credit cards or use most of what is available, it communicates to lenders that your cash flow is low. That means you are at risk of not paying what you have borrowed. Plus, it is good to always have 50% of your available credit in case there is an emergency such as job loss. Building and maintaining good credit is a matter of knowing how to balance your debt and your cash flow. Too much debt is bad but too little is not good either. The longevity of your loans and credit cards help your credit score if your payment history is good. Lenders want to know you have a long history of paying your bills. The accounts you have had open the longest best depict your credit history. Never close a credit card. It is best to just leave it open and use it every now and then and pay it off.

If you are trying to build your credit here is a helpful guide to how lenders view your credit:

Student loans – Good credit – Store credit cards – Not so great – Major credit cards such as Visa, MasterCard, Discover – Good credit

Maxed out credit cards – Not so great – Car loans – Good credit – Unsecured loans – Not so great – Mortgages – Good credit

Secured personal loans – Good credit -I hope this information is helpful.

Sincerely,

Angel Boose

” Leave no brother or sister behind the enemy line of poverty.”

– Harriet Tubman